A brief dip in US Treasury securities yields illustrates the benefits of holding your nerve amid investment ‘noise’.

Professional investor interest has been focusing on US government bond yields, with potential lessons for long term investment.

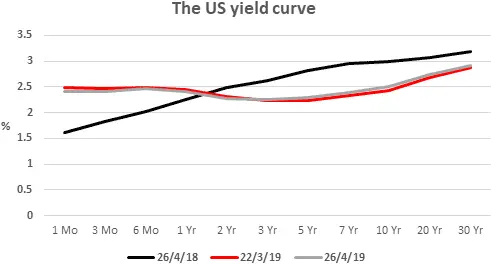

On 22 March the US stock market caught a sudden – and brief – chill. One of the main reasons was the red line in the graph shown.

The ‘technicals’

This shows a yield curve plot, which shows the return an investor would receive from buying US Treasury securities, based on their term to maturity – from one month to 30 years. What happened on 22 March was that the yield on 10-year Treasury bonds fell below that of 3-month Treasury bills.

Usually the longer the term to maturity, the higher the yield, as demonstrated by the black line on the graph, which dates from one year ago. Intuitively that makes sense – the longer the period of time money is lent, the greater the risk that inflation will emerge to erode returns, so the higher the interest rate demanded.

So, what does this actually mean?

History has shown us that when yields fall with lengthening maturities – described in the business as an inverted yield curve – a recession is imminent. The logic is that investors will accept a lower return from longer dated bonds because they anticipate short term rates will be cut to counter the impact of the recession. In the US, the reverse yield curve has a very good track record as a warning flag, which explains the stock market’s reaction to the news.

Whether yield curve movements have retained their predictive capacity is now the subject of some debate. There are those who believe that central bank actions since the 2008 financial crisis have so distorted the bond market that the yield curve can no longer be trusted. On the other hand, there are experts who worry about the credibility of any ‘This time it’s different’ message.

As the graph shows, the inversion has started to fade since March, which means that it may just have been a short-term blip. Certainly, in the US, stock market investors seem to have recovered their nerve, with the main equity market indices at or near all-time highs as April came to an end. Once again, Wall Street has proved resilient in the face of short-term investment ‘noise’….a lesson for all investors.

Whether this is a false alarm or a true sign of the times, our view is that active, professional management of your investments – in whatever tax wrapper you hold; be that ISAs, Collectives or Pensions – is crucial.

Our Prestige investment portfolios are managed in collaboration with an award-winning, City based Discretionary Fund Manager, LGT Vestra LLP. Pembroke have created a globally diversified range of what we call ‘model portfolios’ designed for clients with all investment risk profiles – Cautious through to Adventurous and now 4 specialist investment portfolios in Income, Drawdown, Ethical Cautious and Ethical Balanced. With a quarter of a billion pounds of our clients’ money managed under this Wealth Management proposition, we believe that we can help clients at any stage of wealth accumulation.

Get in touch if you would like to discuss how we can help you make the most of your investments.

Please Note: The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.