August was a rollercoaster month for international markets with interest rates, trade wars and Brexit contributing to a bumpy ride.

Stock markets, as well as some family holidaymakers, experienced a rollercoaster August.

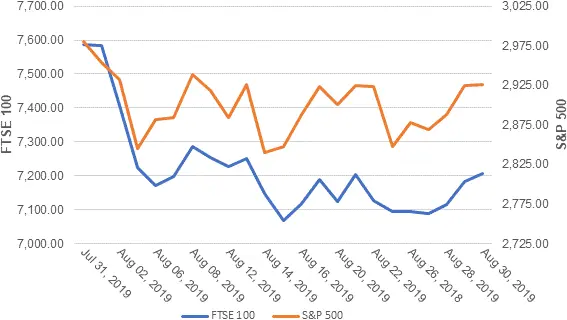

The traditional holiday month proved to be anything but quiet on the world’s investment markets. As the graph of the major UK and US stock market indices shows, there were plenty of sharp lurches, up as well as down.

Inevitably the downward trends attracted more attention, particularly the fall in US share values on 13 August. “Dow drops 800 points” is a headline that newspaper editors find hard to resist. ‘Dow falls just over 3%’ would have been equally accurate, but 800 points sounds considerably more dramatic.

Several factors challenged the stock markets in August:

- Short-term interest rates look set to fall further in the US (where the first cut in ten years took effect at the start of the month). Elsewhere there is less scope to cut as rates are so low, but central banks are hinting at other measures, such as a return of quantitative easing.

- Long-term interest rates also continued to fall, often deeper into negative territory. In the second half of the month the German government sold a 30-year bond which paid no interest and guaranteed investors a loss of 0.11% a year, if they held the paper until 2049!! Tumbling and negative yields are seen by some commentators as an indicator that a recession is looming.

- The trade war between the US and China reignited, with a new round of tariff-by-tweeting from President Trump. In response, the Chinese allowed their currency, the Renminbi, to weaken, with knock-on effects for its neighbours.

- The Brexit saga ratcheted up in the UK and Europe, as the new Prime Minister Boris Johnson adopted his ‘do or die’ stance to 31 October and announced a provocative prorogation of Parliament ahead of the deadline.

Ryan further says “As with any rollercoaster ride, the experience can be both exhilarating and nauseating. It is by no means clear when this particular trip will end, but – again like the rollercoaster – it could be highly dangerous to jump out before the journey finishes.”

Our Prestige investment portfolios are managed in partnership with an award-winning, City based Discretionary Fund Manager, LGT Vestra LLP. Pembroke have created a globally diversified range of what we call ‘model portfolios’ designed for clients with all investment risk profiles – Cautious through to Adventurous and now 4 specialist investment portfolios in Income, Drawdown, Ethical Cautious and Ethical Balanced.

With a quarter of a billion pounds of our clients’ money managed under this Wealth Management proposition, we believe that we can help clients at any stage of wealth accumulation.

Please get in touch if you would like to discuss how we can help you make the most of your investments.

Please Note: The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.