Our thoughts on the impact of the Coronavirus outbreak on global investment markets – and specifically the effect on your investment portfolios… We are here to help.

Clearly, the Coronavirus outbreak is not a traditional macroeconomic event like say, the 2008 Credit Crunch and the ensuing global economic recession or like the early noughties Dot Com bubble.

Pembroke’s thoughts are absolutely with those immediately affected by the spread of the virus but our professional responsibility dictates that our principal consideration is for our clients. We cannot, and will not, aim to predict the future and we most certainly cannot forecast the precise timing of the virus’s spread or the reaction of global stock markets.

We do, however, promise to keep you updated as to how we are approaching this evolving story.

Like almost everyone else, we know very little about this virus and its likely impact on the health of billions of people. Some are looking at models of infection rates or previous outbreaks and trying to divine what will happen this time.

Likewise, Pembroke’s Investment Committee will look for any information advantage using market specific evidence and, in times of increased ‘information uncertainty’, risk management comes to the fore, using both tactical and strategic asset allocation processes in your portfolio.

Our partnership with LGT Vestra gives us additional ‘market nous’ and crucially, the ability to act immediately as we test any investment strategies against historic stressed market events – both factors clearly help us to mitigate unintended risks.

Markets frequently over or under-react and, given the lack of knowledge in this instance, we feel it is impossible to know whether markets have gone too far, or not far enough. What we do know is that opportunities are always created when markets go into a state of flux. This explains why record falls tend to occur very close to record gains.

What is clear is that we are seeing, and are going to see, an economic effect.

The halting of economic activity to contain the virus, the fear factor keeping consumers away from shops, and the disruption to complex international supply chains – such as the present Russia/ Saudi Arabia oil price row – will drag down global growth.

The outbreak is already leading to knock on revaluations in the oil; transport, tourism, events and hospitality; banking; car manufacturing and the retail and luxury goods sectors, to name but a few. How the crisis concludes has a knock-on impact on business and consumer confidence given that when confidence is low, saving tends to go up and spending and investment can fall.

Governmental and central bank fiscal and monetary stimulus (meaning increasing government consumption, lowering taxes, lowering interest rates, quantitative easing and other ways of increasing the amount of money or credit) might well counter some of the worst economic effects of the outbreak and the US Federal Reserve has already implemented one emergency interest rate cut. In the UK, we await the new Chancellor’s Budget on Wednesday with more than the usual anticipation.

The size of the initial shock to both global and localised economic growth, and hence the stimulus policymakers feel is appropriate, will not be clear for some time.

If we look at historical evidence from previous outbreaks such as SARS or Swine Flu, it might suggest that this outbreak probably won’t have a material long term impact on the global economy.

Thus far, it is the measures taken to try and halt the spread that are causing more problems than the virus itself…. the closure of factories, the quarantining of people, the reduction in travel and tourism will inevitably have a negative impact on earnings.

A vaccine is in development, but is unlikely to be available over the next few months. There have also been encouraging stories about treatments becoming available which may ease the symptoms.

Whilst the manufacturing situation in China is improving, whether other countries will enact the draconian measures China has done is yet to be seen – although over the past weekend Italy has introduced radical measures in an attempt to contain the outbreak in the north of the country.

UK and Global equity markets have fallen by over 10% over the past few weeks but, on the positive side, government bonds rallied as markets move to price in rate cuts and if you look at the bond market for your discount rate, the fall in long-term yields continues to make equities look attractive.

The uncertainty caused by the virus and the measures to halt its spread are increasing uncertainty about the outlook, subsequently causing markets to fall. This becomes self-fulfilling as stop losses cause more selling and computer trading kicks in. In addition, media coverage delights in making as much as possible of the market moves, thus increasing the fear in people’s minds.

At times like this, it is important for investors to keep an eye out for the long-term returns and look through the short-term volatility. Naturally this remains a period of high uncertainty and many of us have concerns about the outbreak that go way beyond those as investors.

We cannot be sure when the news on the Coronavirus will improve or how much further the selloff will go, but we encourage investors to take a longer-term view – and remain invested.

It is worth bearing in mind that the tendency of investors to sell on bad news is nearly always detrimental to long term financial gain. It pays to look through the short-term ‘noise’ and hold on through periods of uncertainty for greater medium to long-term gains.

Our portfolios are widely diversified across all asset classes – not only UK and Global Equities but Cash, Bonds, Property and Alternative return strategies.

Our advice

- Don’t panic – volatility in the stock markets is normal and markets often rebound quickly once immediate issues are resolved.

- When investing in the stock market you should be thinking in terms of five years or more, rather than weeks or months, and that is the context through which to view the current turbulence.

- If you are drawing a regular ‘income’ from your investments and you don’t really need that income, consider either stopping or reducing the income draw – perhaps only for a short while and subject to a review in a month or so. Taking the pressure off the capital values of your ISA or SIPP is no bad thing in volatile times.

- It does not make sense to try to time things perfectly because it is impossible. No one knows if it will get worse before it gets better. It’s all about time in the markets, not timing the markets.

- Please don’t hesitate to contact us to chat things over – it is as much our job to be there for you in difficult, turbulent times as is it is when everything is going well.

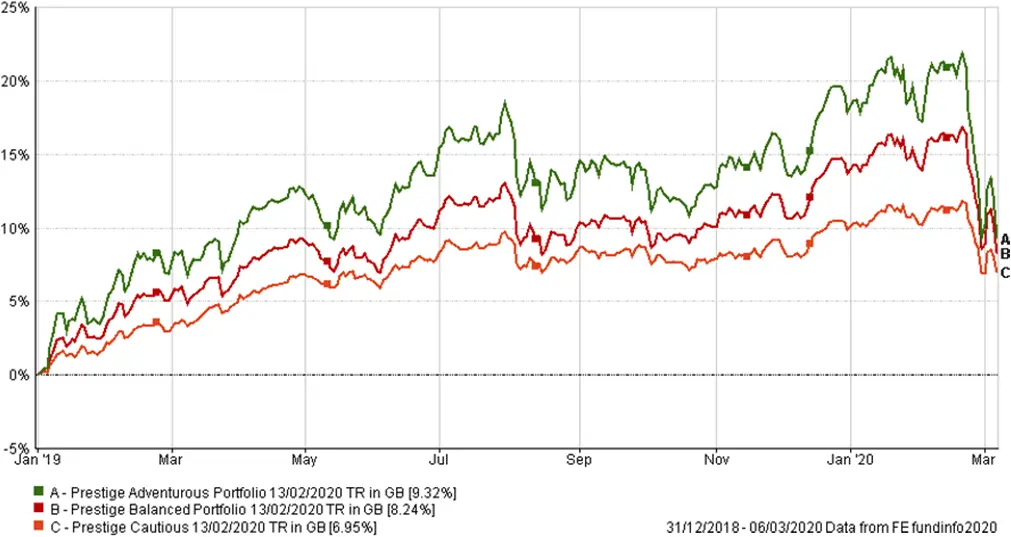

Our perspective point is that only last year (if you were invested) you will have made more in investment profit than you will have seen reversed ‘on paper’ in 2020 to date.

The chart below was produced from FE Analytics and shows the portfolio returns of the ‘extremes’ of investment risk in our Prestige model portfolios (Cautious and Adventurous) and the middle ground, Balanced. The figures are net of fund charges but not platform or ongoing advice charges and cover the whole of 2019 to the date of this report.

It just doesn’t feel like it because the media noise is so loud at present that doom and gloom becomes as much of an epidemic as the virus itself.

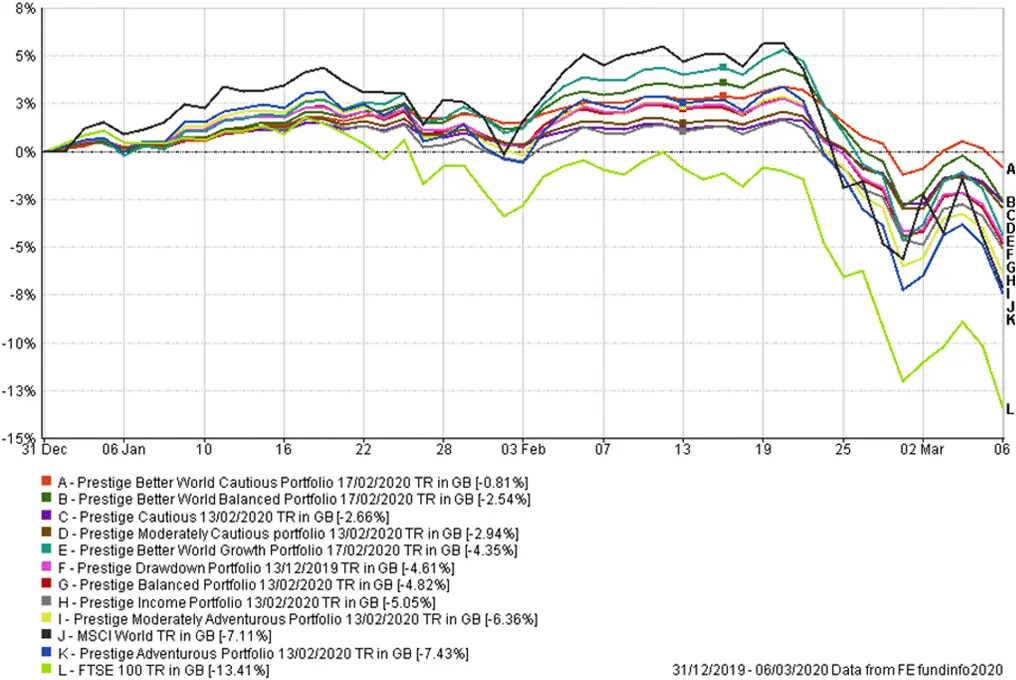

Prestige Portfolio returns year to date v MSCI World and FTSE 100

If there are any questions regarding this article please get in touch. Call us on 01273 774855.

Please Note: It is important to note that returns from investment funds are not guaranteed and the value of your capital and any income taken can fall as well as rise. Past performance should not be seen as a guide to future returns.