Since its introduction in July 2020, the Stamp Duty holiday has helped homebuyers save thousands of pounds on property purchases. We explain how you can take advantage of the holiday.

If you complete a purchase on your main home during the Stamp Duty holiday, you don’t have to pay tax on property values up to £500,000. That’s a saving of up to £15,000, which is certainly not to be scoffed at.

Unfortunately, the Stamp Duty holiday, like every holiday, must come to an end. If you’re thinking of buying a house, you have until 31 March 2021 to take advantage of potential tax savings.

March might sound like far away, however, the Stamp Duty holiday and the release of pent-up demand from spring’s lockdown has resulted in a huge influx of buyers. This means many house purchases are taking longer than usual to complete. To avoid missing out, you must act now.

Here’s how to beat the Stamp Duty holiday deadline.

The sooner you act, the better

According to Zoopla, it’s currently taking just over 100 days for the average property purchase to complete. So, to beat the Stamp Duty holiday deadline, you would need to have an offer accepted on a house by 21 December 2020 at the absolute latest.

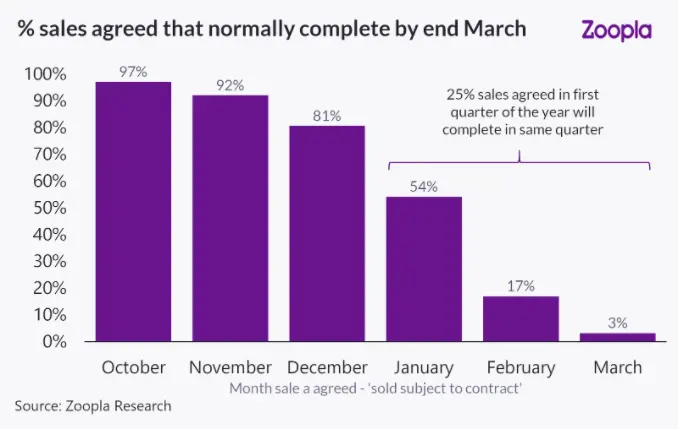

This is just an average figure. In a normal year, not all sales agreed in December would complete by 31 March. The chart below shows your chances of beating the deadline drop dramatically the closer you are to the deadline.

Remember, this is no ordinary housing market. Zoopla has warned that the length of transactions could increase in the short term because of the sheer volume of business. The sales pipeline is 50% bigger than a year ago, which is creating pressure for estate agents, lenders, valuers, conveyancers and other professionals in the housing market.

Richard Donnell, Research and Insight Director at Zoopla, said: “Those who leave it to January to start their search for a home will be cutting it fine – just half of sales agreed in January will convert into a completed sale by the end of March, so those looking to beat the Stamp Duty deadline will need to be well prepared.”

Being organised is crucial

To take advantage of the Stamp Duty holiday, you need to get your ducks in a row. Beginning your property search immediately and trying to agree on a sale before Christmas at the latest will hopefully increase your chances of completing in time.

Some other steps to follow include:

- Get an agreement in principle from a mortgage lender

- Start collecting all the financial documentation you’ll need for the mortgage application stage

- Book your property survey early and allow time to investigate issues

- Make sure your property deposit is readily accessible

- Instruct a good solicitor

If you’ve got a house to sell, there are additional steps to consider. For example, you should find an estate agent straight away, get all your current house’s paperwork together, and complete the property information and fittings and content forms promptly.

Buyers and sellers should keep in regular contact with solicitors, estate agents and mortgage brokers throughout the process. This is especially important if you’re in a lengthy chain. It’s also a good idea to think about your preferred completion date, so you don’t waste time negotiating at the point of exchange.

Your chances of beating the deadline may depend on which region you’re buying in. According to mortgage broker Trussle, buyers in the East Midlands and East of England are at the greatest risk of missing out on the Stamp Duty holiday. However, by following the steps above, you’ll hopefully speed up the things you can control.

Speak to a mortgage broker

Using a mortgage broker can also speed up the property buying process. A mortgage broker will ensure avoidable mistakes don’t end up wasting valuable time, thereby making the mortgage application process as smooth as possible.

You might not realise it, but having an agreement in principle from a lender doesn’t guarantee you’ll get a mortgage. This is because the lender won’t have a complete picture of your financial situation. As a result, you could end up making an offer on a house only for it to be scuppered because of finance.

A mortgage broker will take a thorough look at your finances and give you a more accurate picture of how much you’re likely to be able to borrow. Mortgage brokers also have a better idea of which lenders are likely to approve loans for certain individuals – for example, some lenders look more favourably upon self-employed people than others.

Finally, a mortgage broker will ensure you fill in the mortgage application form correctly and supply all the relevant documentation.

Be mentally prepared for additional delays

Buying a house can be stressful at the best of times, not to mention when you’re trying to beat a deadline that could save you thousands of pounds.

It’s important to realise that even if you follow all the steps above and are as organised as you can possibly be, you might still miss the deadline. Demand for mortgages is extremely high, which is creating bigger delays than usual.

According to a report by The Guardian, it’s taking at least a month from applying for a mortgage to getting a formal offer, which is double the usual two weeks. The conveyancing process is also taking longer because some councils’ staff have been redeployed to deal with the coronavirus crisis.

Being mentally prepared for extra delays will help you stay calm and pragmatic throughout your property purchase.

Get in touch

If you’d like help in securing a mortgage, please get in touch. We can scour the market for the right deal and ensure delays are kept to a minimum. Please contact us for more information.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.