The top 1% of income tax payers account for 27% of all the UK’s income tax collected, but who are they?

A recent report looking at who pays the most income tax revealed some interesting findings. The Institute for Fiscal Studies (IFS) published a briefing note in early August with a detailed answer to the question of what it takes to enter the 1% club.

Around 310,000 people make up this cohort, with some predictable and some not so predictable traits:

- They have taxable income of at least £160,000 in 2014/15. The historic nature of the data reflects both HMRC’s systems and the fact that the 2015/16 numbers were distorted by the introduction of new dividend tax rules in the following year.

- Typically, they are male aged 45–54 based in London, with an additional £550,000 of income. To quote the IFS, the 1% club is “disproportionately male, middle-aged and London-based”.

- They live in 10% of the 650 parliamentary constituencies, which contain half of the top 1% population. In 2000/01, 78 constituencies were needed to reach the halfway mark.

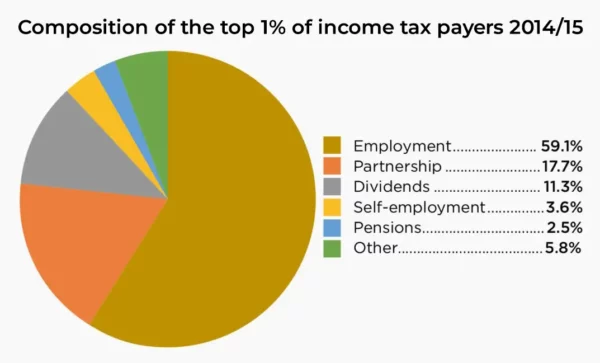

- They have over a quarter of their income made up from partnership and dividends, as the pie chart shows. This reflects the fact that many are business owners.

- They manage fluctuating income levels. The top 1% is not a stable group, which may be some solace if you do not currently have the necessary membership credentials. The IFS found that roughly a quarter drop out each year and only half remain for five consecutive years. The corollary is that there is a much higher chance of being in the top 1% at some point in your life than in any given year. The IFS calculated that 3.4% of all people (and 5.5% of men) born in 1963 were in the top 1% at some time between 2000/01 and 2015/16.

However, being a member of the 1% taxpayers club also means accounting for 27% of all income tax collected by HMRC.

So, failing to qualify may reflect some careful and expert financial planning…

Taxation can be very complex and the rules, reliefs and allowances will change frequently, so it is worth obtaining a clear grasp of how these taxes work by discussing the most efficient way to arrange your finances with a professional adviser. A Financial Planner will be able to help you plan your taxes in advance, and come up with effective strategies which use the legitimate reliefs and allowances to minimise the amount of tax you will have to pay. If you understand how taxation works, you will be better prepared to manage your finances and you could save money in the long run.

For tax planning advice incorporating pensions, investments, savings and inheritance tax, please get in touch.

Please Note: The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.